____________ Are The Costs Of Production That Do Not Change With The Number Of Units Produced?

What is Cost of Product?

Cost of production refers to the total cost incurred past a business to produce a specific quantity of a product or offer a service. Product costs may include things such as labor, raw materials, or consumable supplies. In economic science, the price of product is defined as the expenditures incurred to obtain the factors of production such every bit labor, land, and capital, that are needed in the production process of a product.

For example, the production costs for a motor vehicle tire may include expenses such as rubber, labor needed to produce the production, and diverse manufacturing supplies. In the service industry, the costs of production may entail the material costs of delivering the service, as well as the labor costs paid to employees tasked with providing the service.

Types of Costs of Product

There are various types of costs of production that businesses may incur in the grade of manufacturing a production or offering a service. They include the following:

one. Stock-still costs

Stock-still costs are expenses that exercise not modify with the amount of output produced. This means that the costs remain unchanged even when there is nil production or when the business organisation has reached its maximum production chapters. For instance, a restaurant business must pay its monthly, quarterly, or yearly rent regardless of the number of customers it serves. Other examples of fixed costs include salaries and equipment leases.

Fixed costs tend to be time-limited, and they are just fixed in relation to the production for a certain period. In the long term, the costs of producing a product are variable and volition change from one menstruation to another.

2. Variable costs

Variable costs are costs that alter with the changes in the level of production. That is, they ascent as the production volume increases and decrease as the product volume decreases. If the product volume is zero, then no variable costs are incurred. Examples of variable costs include sales commissions , utility costs, raw materials, and direct labor costs.

For example, in a clothing manufacturing facility, the variable costs may include raw materials used in the product process and direct labor costs. If the raw materials and direct labor costs incurred in the production of shirts are $9 per unit and the visitor produces 1000 units, then the total variable costs are $9,000.

3. Total toll

Total cost encompasses both variable and fixed costs. It takes into account all the costs incurred in the product process or when offering a service. For example, assume that a fabric company incurs a production toll of $nine per shirt, and it produced 1,000 units during the last calendar month. The visitor also pays a rent of $1,500 per month. The total cost includes the variable toll of $nine,000 ($9 x 1,000) and a fixed cost of $one,500 per month, bringing the full cost to $10,500.

4. Average toll

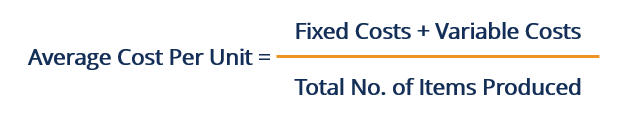

The average price refers to the total toll of product divided by the number of units produced. Information technology can also be obtained past summing the boilerplate variable costs and the average fixed costs. Management uses average costs to make decisions near pricing its products for maximum revenue or profit.

The goal of the company should exist to minimize the average toll per unit of measurement so that it can increase the profit margin without increasing costs.

5. Marginal cost

Marginal cost is the price of producing one boosted unit of output. It shows the increase in total cost coming from the product of one more product unit. Since fixed costs remain constant regardless of any increase in output, marginal cost is mainly afflicted by changes in variable costs. The direction of a company relies on marginal costing to make decisions on resource allocation, looking to classify production resource in a way that is optimally profitable.

For example, if the visitor wants to increase production capacity, it will compare the marginal price vis-à-vis the marginal acquirement that volition exist realized by producing one more unit of output. Marginal costs vary with the volume of output being produced. They are affected by various factors, such as price discrimination , externalities, data disproportion, and transaction costs.

How to Calculate the Price?

The first step when computing the toll involved in making a product is to determine the stock-still costs. The next step is to determine the variable costs incurred in the product process. Then, add the fixed costs and variable costs, and divide the total cost by the number of items produced to get the average cost per unit.

For the visitor to make a profit, the selling price must be higher than the toll per unit of measurement. Setting a price that is below the cost per unit volition upshot in losses. It is, therefore, critically important that the company be able to accurately assess all of its costs.

Additional Resources

CFI is the official provider of the Financial Modeling and Valuation Annotator (FMVA)® certification program, designed to transform anyone into a world-class financial analyst.

To continue learning and developing your knowledge of financial analysis, we highly recommend the additional CFI resources below:

- Disproportionate Information

- Toll Structure

- Stock-still and Variable Costs

- Negative Externalities

Source: https://corporatefinanceinstitute.com/resources/knowledge/finance/cost-of-production/

Posted by: eberledife1967.blogspot.com

0 Response to "____________ Are The Costs Of Production That Do Not Change With The Number Of Units Produced?"

Post a Comment